Category: Small Business

-

Advantages of Hiring Your Child for a Summer Job – at Your Office!

Your kids can gain bona fide on-the-job experience, save for college and learn how to manage money. You may be…

-

Planning Tax-deductible business expenses for Summer

We’ve compiled a list of sun-loving activities to help your business thrive, so you can harness the laid-back vibes of…

-

New Filing Requirement for Businesses

Beneficial Ownership Filing Requirements (FinCEN Required Filing) Beneficial Ownership information refers to identifying information about the individuals who directly or…

-

Spring Clean Your Business Finances

Spring cleaning your business finances after tax season is more than just tidying up—it’s about optimizing your financial processes, identifying…

-

How to Read Your Cashflow Statement

Your business needs to consider three important financial statements: a profit and loss statement, balance sheet, and cashflow statement. The cashflow…

-

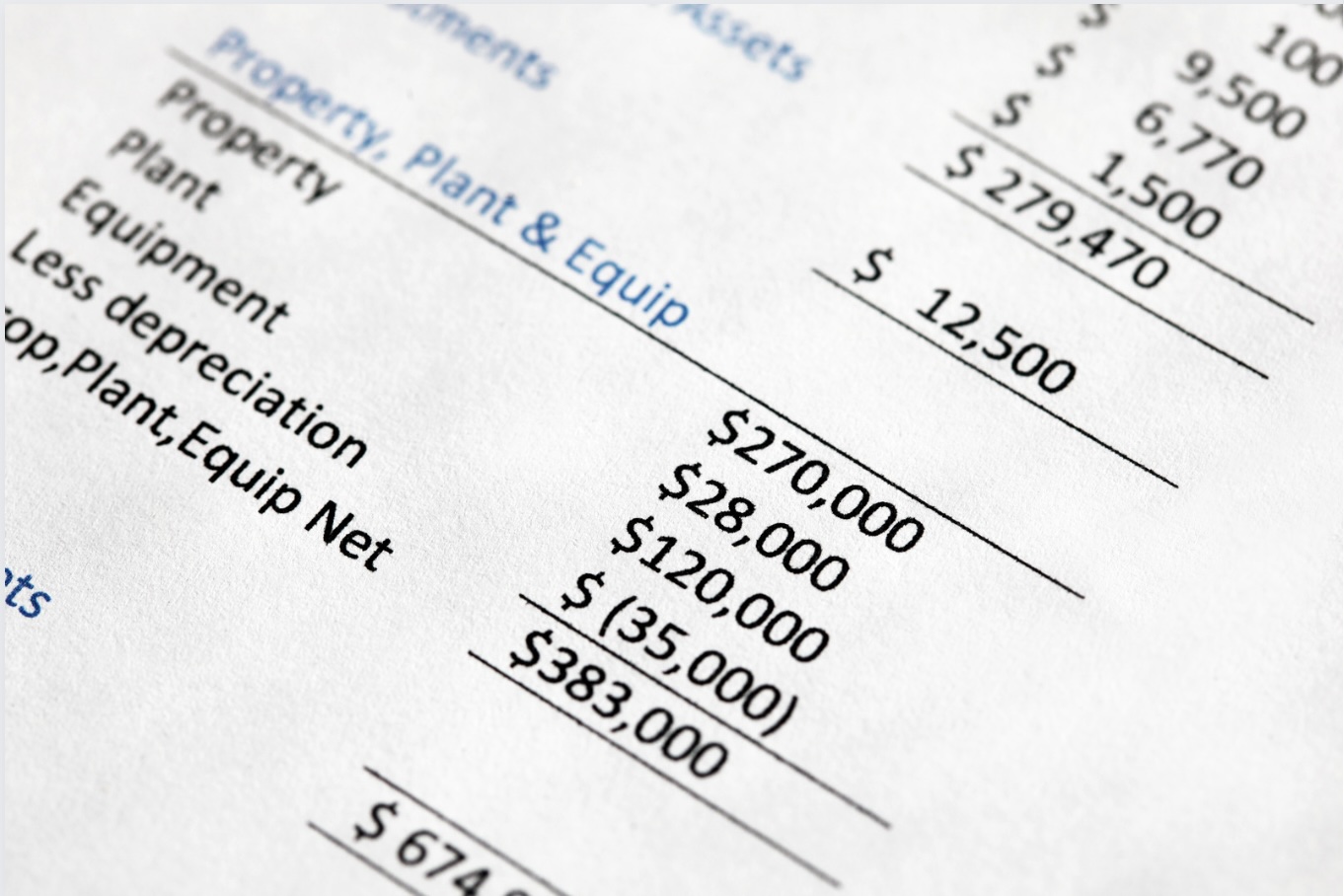

How To Read Your Balance Sheet

By examining the balance sheet, you can gauge a company’s liquidity and working capital position. You can also compare different…

-

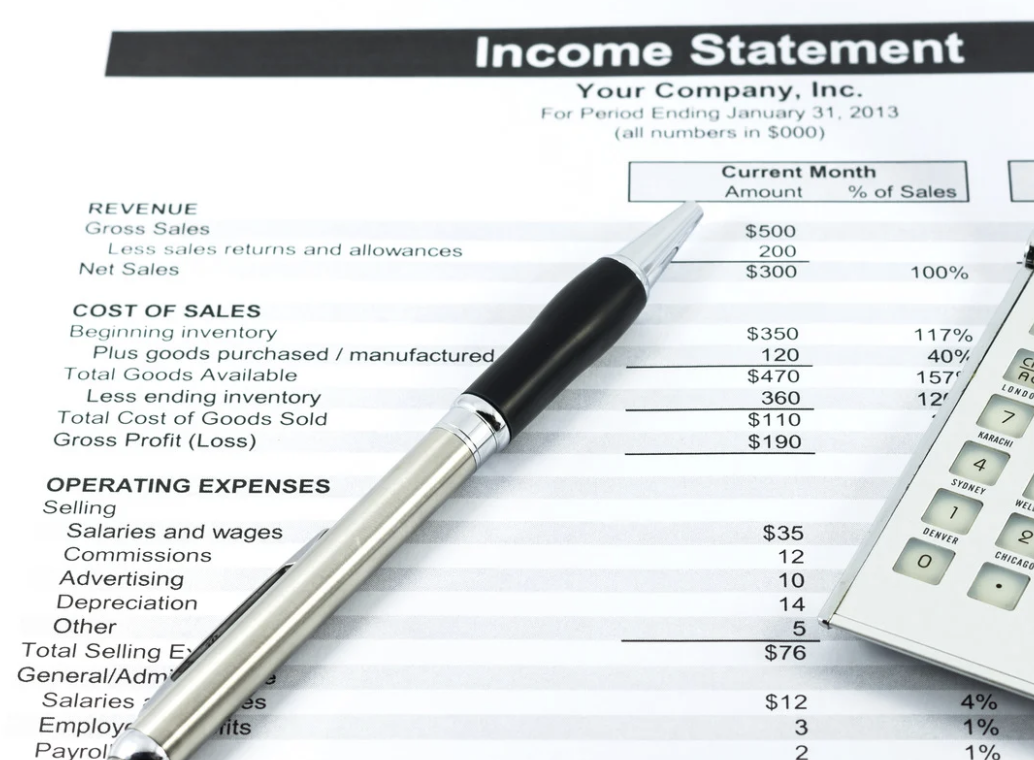

How to Read Your Profit & Loss Statement

A profit and loss statement provides insights into the financial health and profitability of a company.

-

The Electric Vehicle Tax Credit

Are you considering buying a new car for your business? Investing in electric vehicles (EVs) or plug-in hybrid technology may…

-

Are Your Goals SMART for Your Business?

SMART goals are specific, measurable, achievable, relevant, and time-bound objectives that provide a framework for business planning and performance management.

-

Business Owner’s Year-End Financial Planning Checklist

Use this end-of-year financial planning checklist to review the business’s financial performance, prepare for the upcoming tax season, create budgets,…