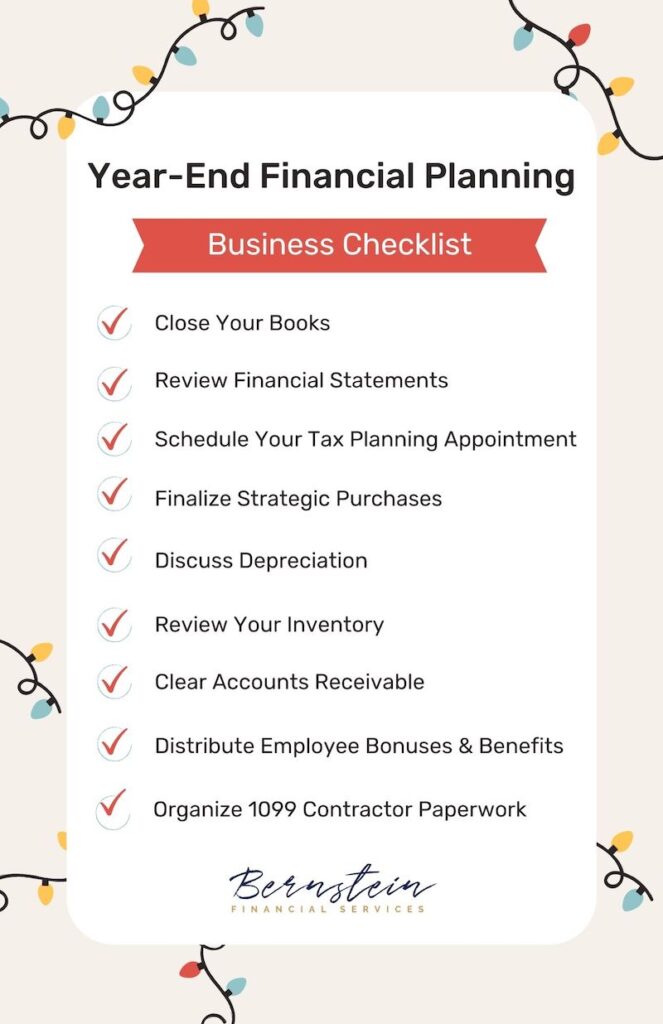

It’s that time of the year! Between holiday shopping trips and brewing cups of hot cocoa, business owners can use this end-of-year financial planning checklist to review the company’s performance. Additionally, you can use it to prepare for the upcoming tax season, modify budgets, and identify areas of improvement in the upcoming year.

Year-End Financial Planning Checklist For Businesses

Close Your Books – Don’t rush this process. Clear communication and consistent collaboration with your company’s bookkeeper is essential to ensure a smooth closing process. Common mistakes that we see include failing to reconcile bank statements, accounts receivable, or accounts payable; incorrectly estimating or recording accruals and deferrals; incomplete record-keeping; and double entries in QuickBooks.

Review Financial Statements – Review your profit and loss statement, balance sheet, and cashflow statements to assess your business’s financial health. The three together provide valuable information, such as areas where you can cut costs and improve profitability.

Schedule Your Tax Planning Appointments – Give yourself several weeks or months to consult with your financial team. They should provide tailored advice based on your business structure and financial situation. For example, if your business is a pass-through entity, such as an S-Corporation or Partnership, your tax team may utilize the Section 199A deduction, which allows certain businesses to deduct up to 20% of qualified business income.

Finalize Strategic Purchases – Finish making your strategic purchases and repairs that will reduce your business’s taxable income for the current year. Your business’s year-end equipment purchases must be installed and operational by the last day of the year. Are you including these business tax deductions?

Discuss Depreciation – If your business purchased machinery, equipment, computers, furniture, and certain types of vehicles, your financial team may use a depreciation methods – including straight-line depreciation, declining balance depreciation, or units of production depreciation – to spread the cost of the asset overtime. Alternatively, the Section 179 deduction allows businesses to deduct the cost of qualifying property rather than depreciating it over several years.

Review Your Inventory, if Applicable – Proper inventory management can help reduce your taxable income. Review your inventory levels and consider writing off obsolete or unsold items that may tie up warehouse space that could be used for more profitable items. Additionally incorrectly valuing inventory (e.g., using outdated or inappropriate methods) can lead to financial discrepancies.

Clear Accounts Receivable – Collecting the outstanding payments owed to your business by its customers is essential for maintaining a consistent cash flow and can even have tax benefits. It may be worth offering incentives for early payment, re-negotiate payment plans, or engaging a debt collection agency. Create a plan to send friendly, professional payment reminders via email, phone, or snail mail. Be sure to clearly state the payment terms, due dates, accepted payment methods, and any penalties for late payments.

Distribute Employee Bonuses & Benefits – If your business provides employee benefits or contribute to a retirement plan, such as a 401(k) or SEP IRA, these contributions are deductible and can also boost employee morale. Ensure you are compliant with California’s Affordable Care Act or updated government regulation for your state regarding health insurance to employees.

Organize 1099 Contractor Paperwork – Your business must submit its 1099s in January, so be sure that your independent contractors have submitted their W-9 forms.

Completing these tasks in the weeks before the last day of the year will help with more than just tax season. You will be empowered to make informed decisions and ensure the financial success of your entities.

Bernstein Financial Services Inc. has guided business owners through the complexities of the tax code and improved their profit margins since 1989. This article is for educational purposes only and should not be taken for business advice about your specific situation. Schedule a consultation appointment with a Principal at Bernstein Financial Services to help you determine your optimal planning strategies.