Your company’s internal bookkeeper has chosen to download bank and credit card transactions directly into your QuickBooks. What could possibly go wrong?

Though online banking integrations are useful features, if not carefully set up, they can wreak havoc on your books and negatively impact your Financial Statements. In this article, we will discuss double entries, a common bookkeeping error that is quite time consuming to fix, so knowing how to identify and avoid these mistakes will save your company time and money.

Double entries occur when bookkeepers download the payment for their credit cards both in the credit card download online module as well as the bank online download module, thereby creating a double entry of one payment. This payment should only clear the bank account once. If it clears more than once it shows an inaccurate.

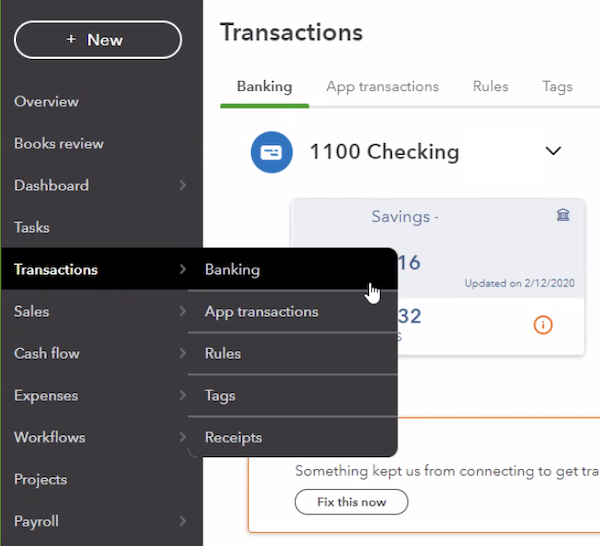

To fix this, only download the payment for a credit card in the banking module and exclude the payments that appear in the credit card module. In other words, only download the payment for a credit card in the banking module – not in the credit card module. For more information, watch the video below!

The second place that we see “double downloads” and similar online banking issues is when bookkeepers re-download from a prior period. They’ve already downloaded transactions, and it’s already been posted in the ledger, thereby double posting income, expenses, fixed assets, loan payments, etc. that are already there. This common bookkeeping error can cause your Profit & Loss to have an inaccurate net income and/or a Balance Sheet that is not a true representation of the Assets vs. Liabilities & Equity. This incorrect information will likely cause an incorrect tax amount to be computed on a tax return.

So, it’s very important that your bookkeeper downloads the transactions only once. An important way your bookkeeper can identify errors in the bookkeeping is to preform regular reconciliations. That’s a way to catch if you’ve double downloaded.

We hope that our clients and small business owners can accurately set up their books to avoid costly mistakes in the future. Financial Statements are the Profit & Loss and Balance Sheet. Having an organized set of Financial Statements is important. A disorganized Profit and Loss might not accurately show your income and expenses. Having unbalanced Asset and Liability accounts on the Balance Sheet can cause an inaccurate financial position of the Company. Also, we use the Financial Statements to do a tax return efficiently. For instance, when you’re applying to a bank for a loan, your Financial Statements will determine how much money you qualify for.

This article is for educational purposes only and should not be taken for business advice about your specific situation. Please schedule an appointment with a Principal at Bernstein Financial Services to help you determine your optimal planning strategies.