Small business Owners’ Blog

We value sharing knowledge with our teammates and our clients regularly, and are committed to sharing seasonal updates. Click through the blog categories or browse through our article archives below.

-

Planning Tax-deductible business expenses for Summer

-

How To Save Money With California’s “SALT” Workaround

-

Beware of misleading ERC refund info—IRS cracking down on ERC fraud

-

Do you qualify for Employee Retention Credits? [Quiz]

![Do you qualify for Employee Retention Credits? [Quiz]](https://bernsteinfinancial.com/wp-content/uploads/2023/09/Bernstein-Financial-Services-figure.jpg)

-

What qualifies as deductible business travel expenses?

-

Advantages of Hiring Your Child for a Summer Job – at Your Office!

-

New Filing Requirement for Businesses

-

Spring Clean Your Business Finances

-

How to Read Your Cashflow Statement

-

Navigating Your Real Estate Development Timeline

-

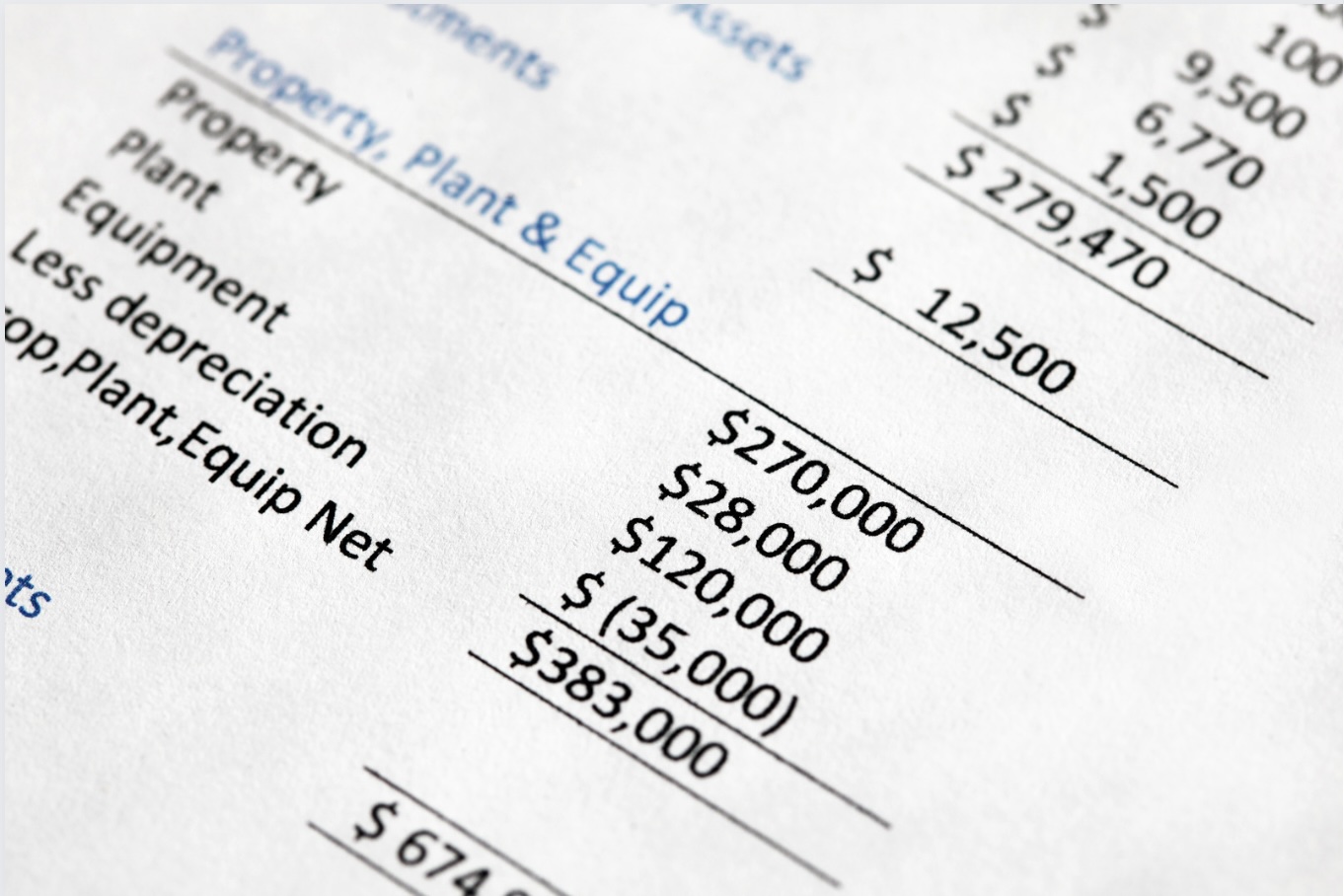

How To Read Your Balance Sheet

-

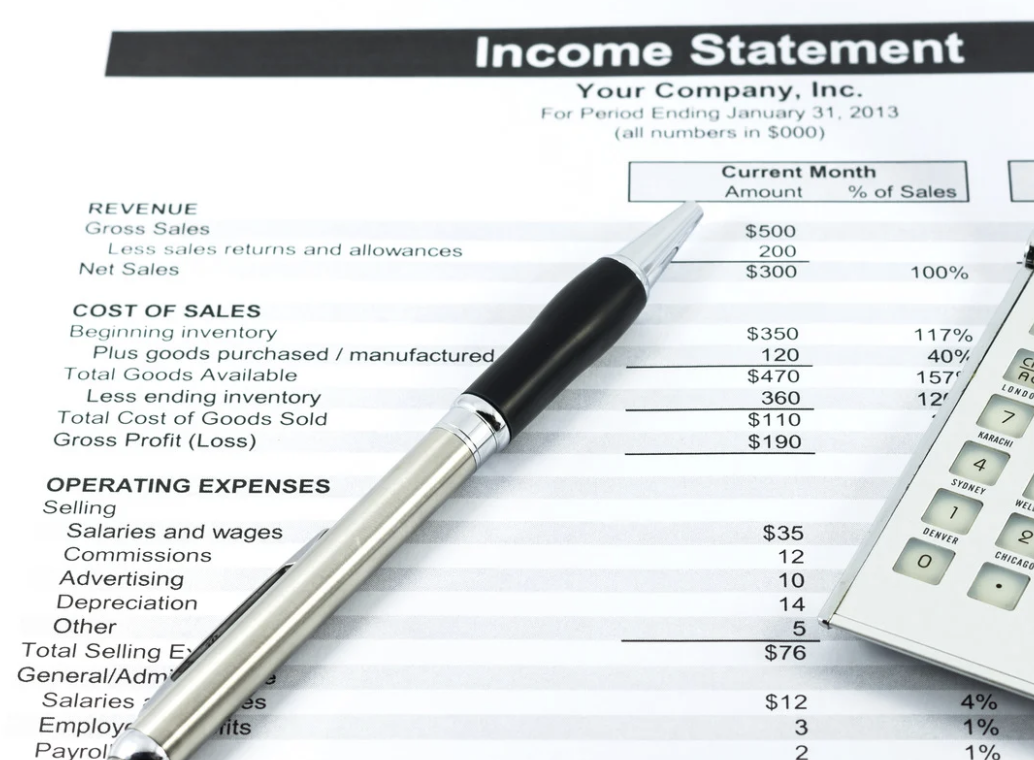

How to Read Your Profit & Loss Statement

-

How To Scan & Upload Your Documents with SmartVault