Your business needs to consider three important financial statements: a profit and loss statement, balance sheet, and cashflow statement. Here is how to read your P & L statement to understand how your business is performing.

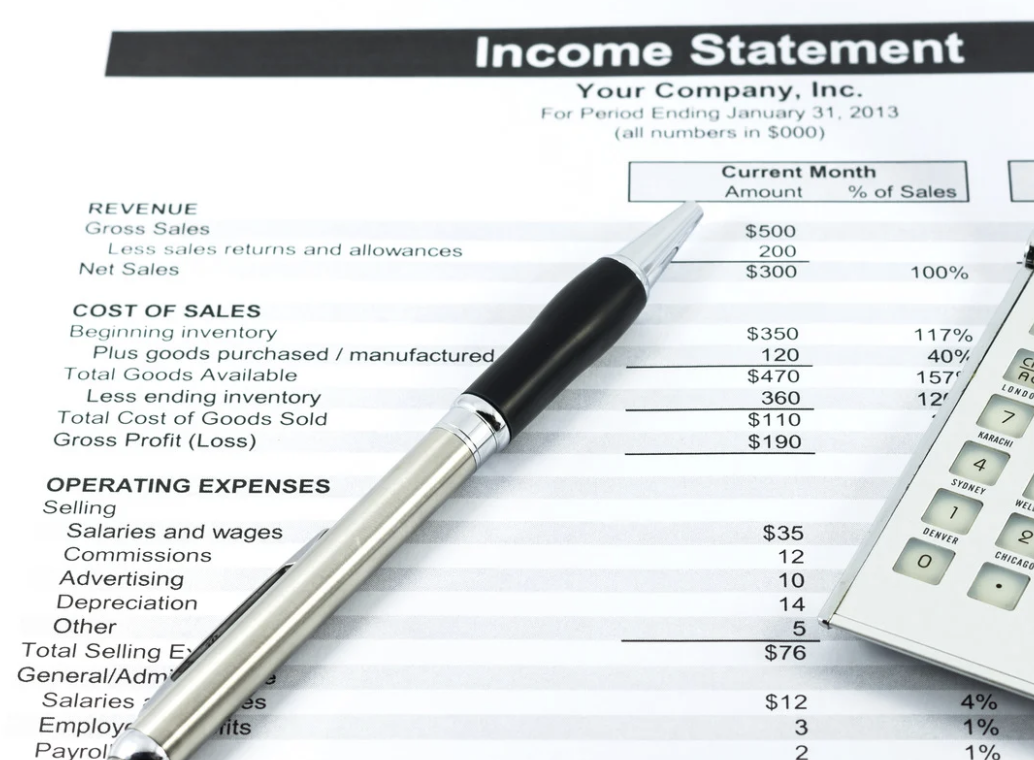

A profit and loss statement, also known as an income statement, summarizes a company’s revenue, costs, and expenses over a specific period of time. It provides insights into the financial health and profitability of a company.

There are many types of profit and loss reports that you may review. Prepared by the company’s controller or business accountant, the profit and loss statement should be examined consistently, at least monthly and quarterly, by the business owner or management teams. The yearly profit and loss statement is reported to the IRS on the company’s annual federal income tax return.

In this article, we help you understand how to review your profit and loss statement.

On the first line of the statement, you’ll find revenue, which represents the total income your company has generated from its services and sales. Revenue is produced by your company’s core business operations.

The cost of delivering your services or cost of goods sold (COGS) is reported after revenue of the profit and loss statement. These costs correlate with revenue: how much did it cost to deliver this service or create that product? This complex calculation is carefully monitored by your controller or business accounting team, because simple omissions can impact profitability. Errors can have dramatic tax consequences. COGS excludes any costs required to operate your business overall – that is outlined later.

Gross Profit or gross marginis a simple yet fundamental business calculation: (Revenue) – (COGS). In other words, after your company spent money to deliver its services and products, how much did you have at the end of the month? Revenue can be misleading. Even when revenue is high, a company’s gross profit may fluctuate if the cost of services and sales has dramatically changed throughout the season.

Operating Costs are expenses that keep your business running nice and smoothly, and are not attributed to specific products or items. Costs associated with operating your business include employee salaries and bonuses, rent payments and deposits, consultant fees, and any almost any cost that isn’t COGS. Often referred to as overhead, these expenses should be reviewed closely for excess.

Business owners need to make large purchases on, for example, equipment, vehicles, or technology. The cost of using long-term operating assets is a complex calculation called depreciation. Your controller or business accounting team break out expensive purchases over time.

These depreciation calculations and operating costs are combined and reported as total operating expenses.

Operating profit or operating earnings is another critical calculation for your business: (Gross Revenue) – (Total Operating Expenses). This refers to all the money that a company has after meeting its operating expenses, but before paying its taxes and interest.

Interest expense is actually not an operating expense, because it is dependent on the amount of debt acquired by the business. This figure may fluctuate with interest rates. Interest is deductible to determine annual taxable income. (Sometimes, when a business is organized as a pass-through entity, it may not pay income tax itself and it becomes taxable income for the year for its owners.)

Finally, the Net Income (or loss) is last number at the bottom of the profit and loss statement. When applicable, Income tax expense is reported as the last expense on the P&L report.

Business owners should use a double entry accounting program like QuickBooks to reconcile their bank statements to ensure that every entry is captured. Keeping track of hundreds of entries by hand or with a spreadsheet won’t guarantee that you won’t miss any expenses and accidentally not write them down.