Your business needs to consider three important financial statements: a profit and loss statement, balance sheet, and cashflow statement. Here is how to read your balance sheet to understand how your business is performing.

The balance sheet offers a behind-the-scenes look at a company’s performance during a specific period of time. Prepared by the company’s controller or business accountant, it breaks out the details behind a fundamental business equation: assets – liabilities = owners’ equity.

By examining the balance sheet, you can gauge a company’s liquidity and working capital position. You can also compare different periods of time to identify trends and assess performance.

How To Read Your Balance Sheet

At the top or the left of your balance sheet, you will find assets, which are resources owned by the company. Assets include cash in your register, deposits in your business checking accounts, buildings, equipment, and inventory.

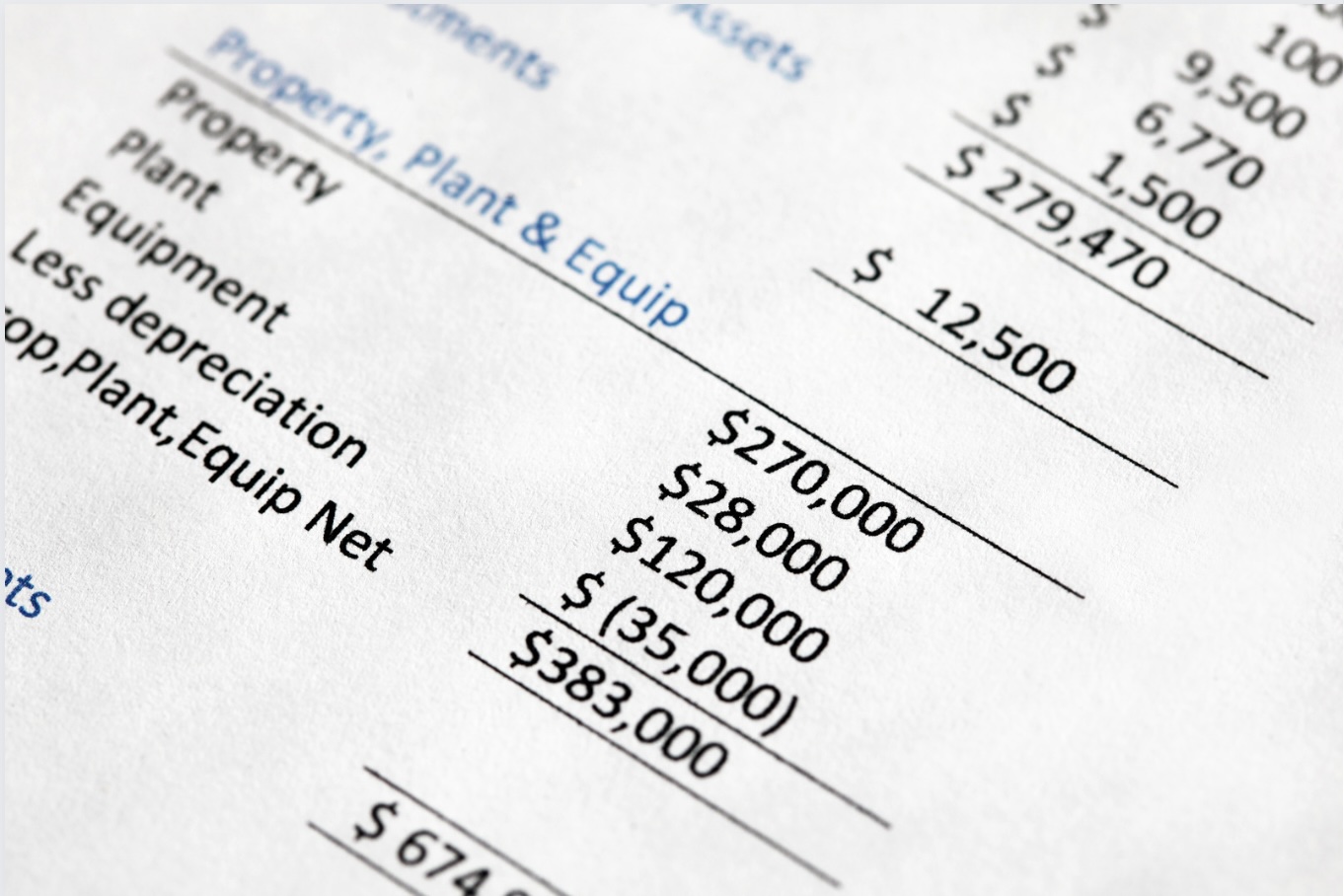

Some assets are classified as fixed, meaning they aren’t easy to buy and sell fast and that they lose value over time. Fixed assets, such as buildings, vehicles, and equipment, are therefore depreciated over time by your accountant to reflect their aging and decline in long-term value.

Liquid assets are generally financial instruments that you can liquidate or acquire quickly, like cash on hand or money in investment accounts.

Other assets are considered prepaid expenses, which include such things as insurance and property taxes. They are classified as assets until the expense is charged.

The last category is money your customers owe you for work done, but that you have not yet collected from your customers, classified as accounts receivable. You want to keep an eye on these. If your customers don’t pay on time, these move over to the other side of the balance sheet and become liabilities.

Total assets are added up at the bottom of this section of your balance sheet.

On the other side of the balance sheet are liabilities, which includes anything the company owes. Current liabilities are due within twelve months. Payroll, bills from vendors, lease payments, and credit card payments, loans from private lenders, past due accounts receivables, and interest are recorded before long-term liabilities. These add up total liabilities.

Owner’s equity is the difference between assets and liabilities. How this difference is reported depends on how the business entity is legally organized. They could be listed as funds invested by the owner or as capital. If you have taken money out of the company or used a company credit card for personal reasons, you might classify the amount as an owner’s draw, which reduces capital.

And finally at the bottom of the balance sheet, you will find total liabilities and owner’s equity or capital. Together, this amount should should equal or balance out against total assets. That is how the balance sheet gets its name.

Investors, creditors, and analysts use the balance sheet to assess your company’s financial health. Ratios derived from the balance sheet help assess the company’s ability to cover short-term obligations with short-term assets, which is important before investors or lenders enter into a financial relationship with your company.