Small business Owners’ Blog

We value sharing knowledge with our teammates and our clients regularly, and are committed to sharing seasonal updates. Click through the blog categories or browse through our article archives below.

-

The Electric Vehicle Tax Credit

-

Are Your Goals SMART for Your Business?

-

How To Save Money With California’s “SALT” Workaround

-

What Is an Enrolled Agent—and Could Your Business Benefit from EA Advice?

-

Business Owner’s Year-End Financial Planning Checklist

-

Are You Claiming these Business Tax Deductions?

-

Beware of misleading ERC refund info—IRS cracking down on ERC fraud

-

Prop 19: The Pros & Cons for California Estate Planning

-

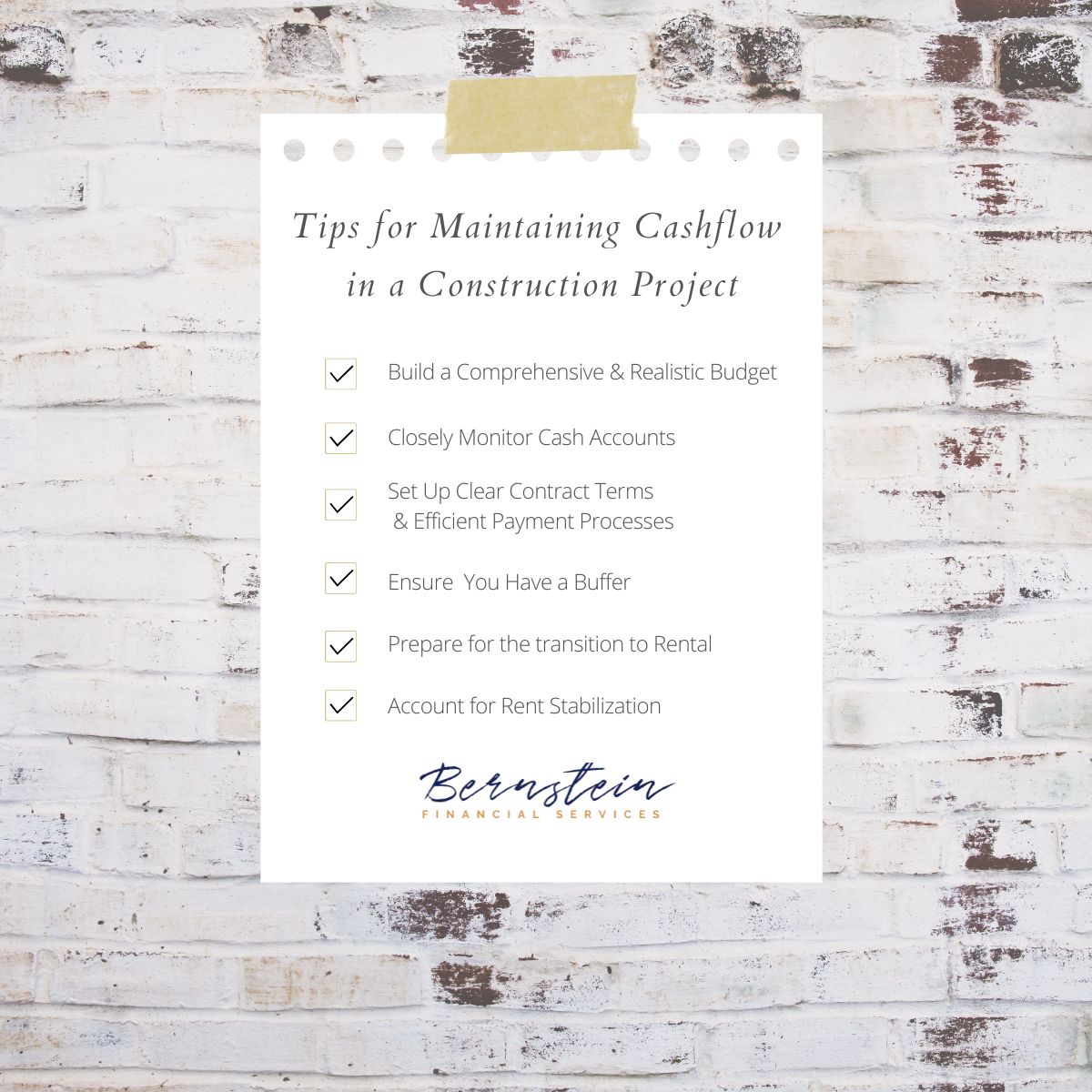

Tips for Maintaining Cashflow in a Construction Project

-

Have You Heard of the Energy Efficient Home Credit?