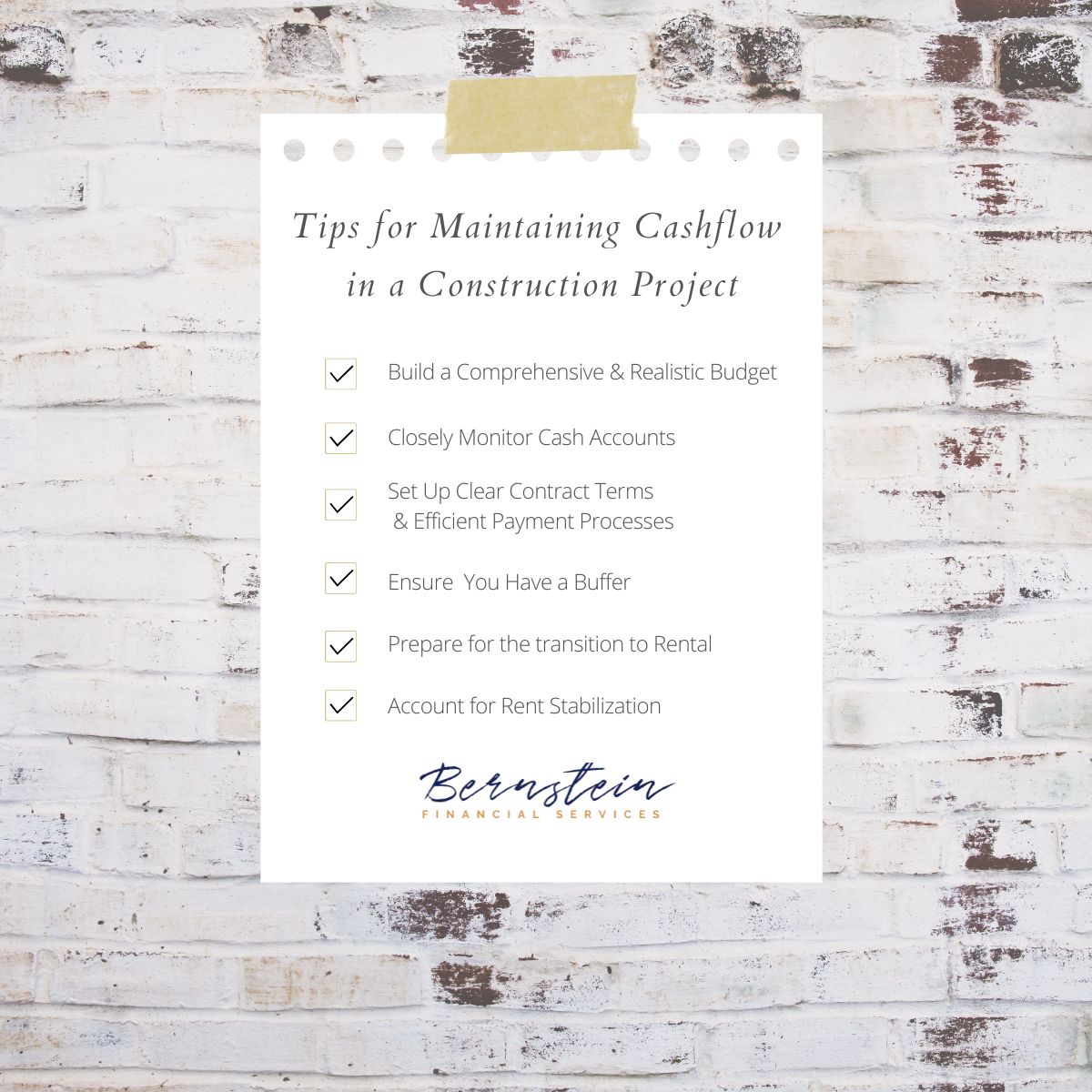

Managing your cash flow during a construction project might seem like a challenging task, but it doesn’t have to be. As with everything related to your construction project, it all comes down to developing an effective system. Once you check a few boxes, you can make cash flow management much more effortless.

Build a Comprehensive and Realistic Budget for your Construction Project

Work with an experienced consultant to develop a cash flow forecast that estimates your expected income and expenses over a specific period. This will give you a clear picture of the project’s financial requirements.

Consider all of the expenses, including your materials, labor, permits, equipment, and overhead costs. Do not underestimate your true land costs. Also, break down your construction project into different milestones, with each having clear deliverables and costs.

Closely Monitor Cash Accounts

Review the project’s expenses and compare them against your budget. Regularly review financial statements, cash flow reports, and adjust your forecasts if necessary. Taking a proactive approach will help you identify any cash flow issues early on and take appropriate actions. You can explore cost-saving measures when possible, but do not compromise the quality or safety of the project.

Set Up Clear Contract Terms with Contractors & Efficient Payment Processes

In order to minimize payment disputes and ensure a steady cash flow, create contracts with clear payment terms and conditions. Streamlined invoicing procedures will also ensure timely billing. Follow up promptly on outstanding invoices. Some clients also offer incentives for early payments rather than applying penalties for late payments.

Make Sure You Have a Buffer

Most developers leave some fluff in their budget. They add 10% contingency to everything that they’ve estimated but guess what? Some overruns even go beyond that. And what happens when you don’t have the money? Your customers, investors, and lenders surely won’t be happy to hear you are over budget.

Try if you start the project with money in excess of the contingency. Then, just leave it alone in case you run out of money at any point during your project. You can return it to the investors later or create an additional reserve fund for future years during rental operation.

Prepare for the Expenses of the Transition to Rental

You must plan the stabilization process and related costs in advance. You should be ablr to start renting out the units as soon as the project is finished. In fact, you should have people lining up weeks in advance. This is yrt another reason why you must move beyond the obvious costs. Don’t get so caught up in the construction phase that you forget what needs to happen afterward.

Account for Rent Stabilization

When you start earning money right away, you can stabilize the rent. You can fill the entire capacity of your building and know exactly how much expenses and income are recurring. This isn’t just important to you, but the loan company as well. When you stabilize your project, you can turn your construction loan into a permanent loan.

Bernstein Financial Services Inc. has guided business owners through the complexities of the tax code and improved their profit margins since 1989. This article is for educational purposes only and should not be taken for business advice about your specific situation. Schedule a consultation appointment with a Principal at Bernstein Financial Services to help you determine your optimal planning strategies.