Are you considering buying a new car for your business? Investing in electric vehicles (EVs) or plug-in hybrid technology may offer more benefits over traditional internal combustion engine vehicles than you might expect.

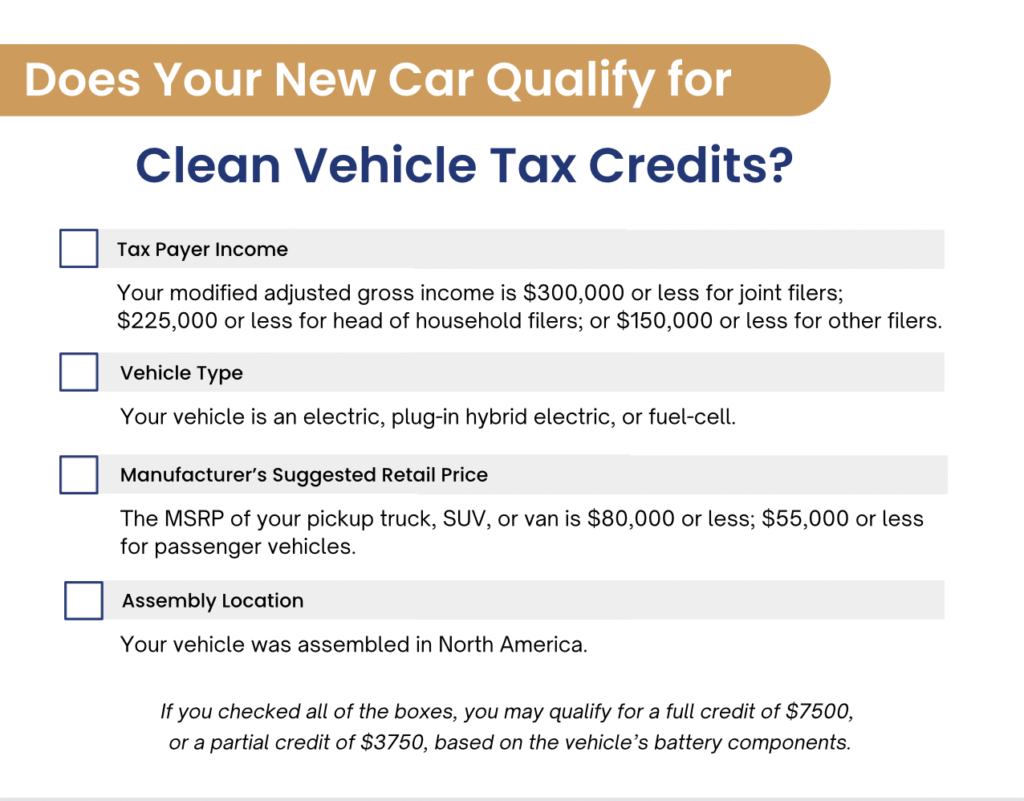

The Inflation Reduction Act provides taxpayers with credits for qualified new and previously owned clean vehicles acquired and placed in service during the taxable year. This tax benefit allows for a maximum credit of $7,500 for new electric vehicles, and up to $4,000, limited to 30% of the sale price, for used electric vehicles for years 2023 through 2032. You can only claim one credit per vehicle.

Beginning Jan. 1, 2024, business owners may be able to transfer the new and previously owned clean vehicle credits to eligible entities. These financial incentives can significantly reduce the overall cost of purchasing electric vehicles, making them a more attractive option for your bottom line.

If you’re purchasing a used vehicle, consider these other qualifications:

- Used car must be plug-in electric or fuel cell with at least 7 kilowatt hours of battery capacity.

- Only qualifies for the first transfer of a vehicle.

- Purchase price of car must be $25,000 or less.

- Car model must be at least two years old.

- Vehicle must weigh less than 14,000 pounds.

- Credit can only be claimed once every three years.[3]

Carefully consider your business’ needs, budget, and long-term goals and consult with a tax professional to determine whether transitioning to EV makes sense for you.

Your business may be able to lower operating costs because electricity is generally cheaper than gasoline or diesel fuel, and electric vehicles require less maintenance because they have fewer moving parts and don’t need oil changes.

Electric vehicles can travel longer distances on the same amount of energy. This efficiency can be particularly advantageous for businesses with delivery or transportation of materials, as it can reduce the frequency of refueling or recharging stops.

Many businesses opt for electric vehicles to demonstrate their commitment to environmental responsibility and meet corporate sustainability goals. Electric vehicles produce zero tailpipe emissions, reducing a business’s carbon footprint and contributing to environmental sustainability. Embracing electric vehicles demonstrates a forward-thinking approach and a willingness to adopt innovative technologies.

As the world moves toward sustainable energy solutions, investing in electric vehicles positions businesses for the future. Having a fleet of electric vehicles can be a strategic decision to remain competitive and adaptable in a changing market.

This article is for educational purposes only. It should not be taken for business advice about your specific situation, as it is not comprehensive in determining qualifications for individuals or businesses. Consult with a tax professional to determine what type of vehicle your business may qualify for.

Bernstein Financial Services Inc. has guided business owners through the complexities of the tax code and improve their profit margins since 1989. Schedule a consultation appointment with a Principal to help you determine your optimal planning strategies.