Beneficial Ownership Filing Requirements (FinCEN Required Filing)

Beneficial Ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

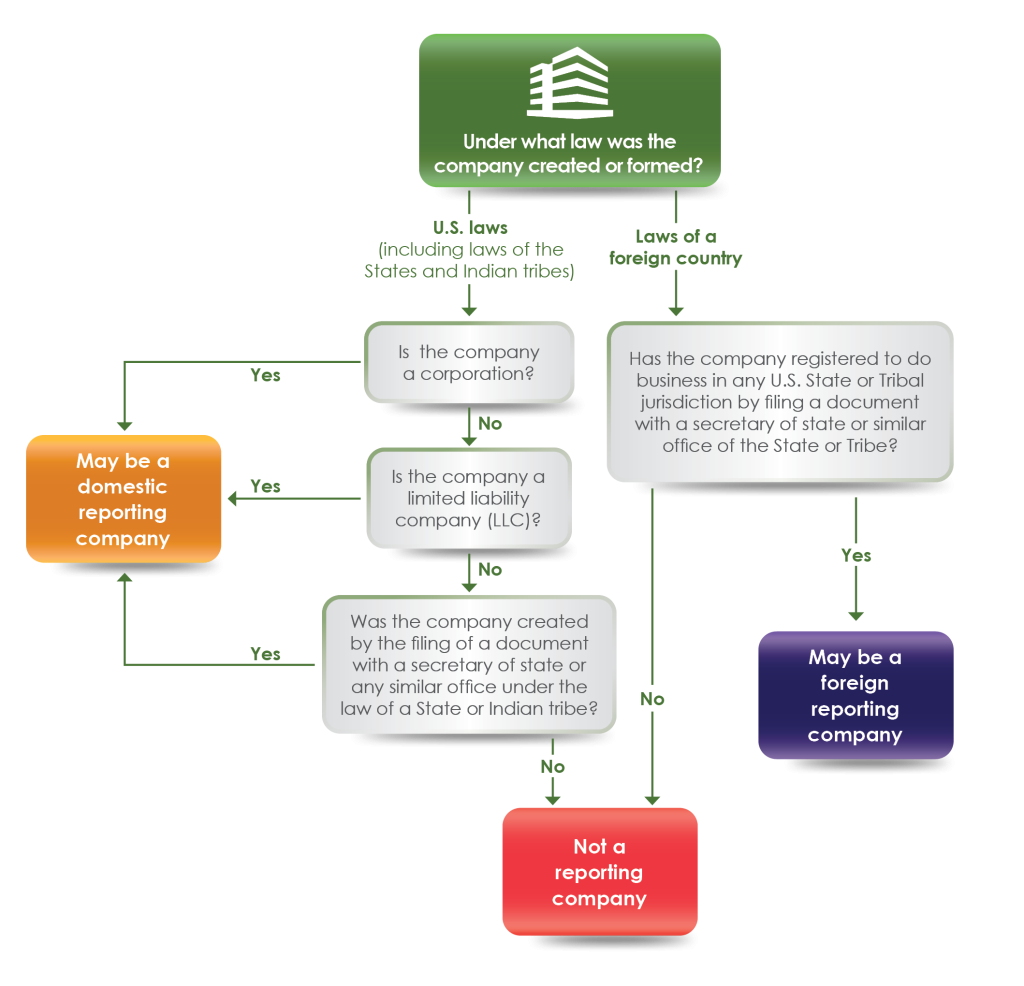

What type of company must file:

Corporations, S-Corporations, LLC’s including Single Member LLC and Partnership LLC

When do you have to file:

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial BOI report.

A reporting company created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

A reporting company created or registered on or after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice that its creation or registration is effective.

How do you file:

You can go online https://www.fincen.gov/boi/small-business-resources and file this yourself.

Bernstein Financial services may be offering a filing service for this requirement, but it will not be automatically done; prior arrangements and an executed engagement will be needed. See the following flow chart for some details on reporting requirements.

Leave a Reply